The global game industry continues to evolve, reflecting shifts in developer demographics, workplace conditions, and emerging trends. The 2025 Game Developers Conference (GDC) State of the Game Industry report, compiled from over 3,000 developers worldwide, offers an in-depth look at these changes.

The Impact of the Game Industry Layoffs

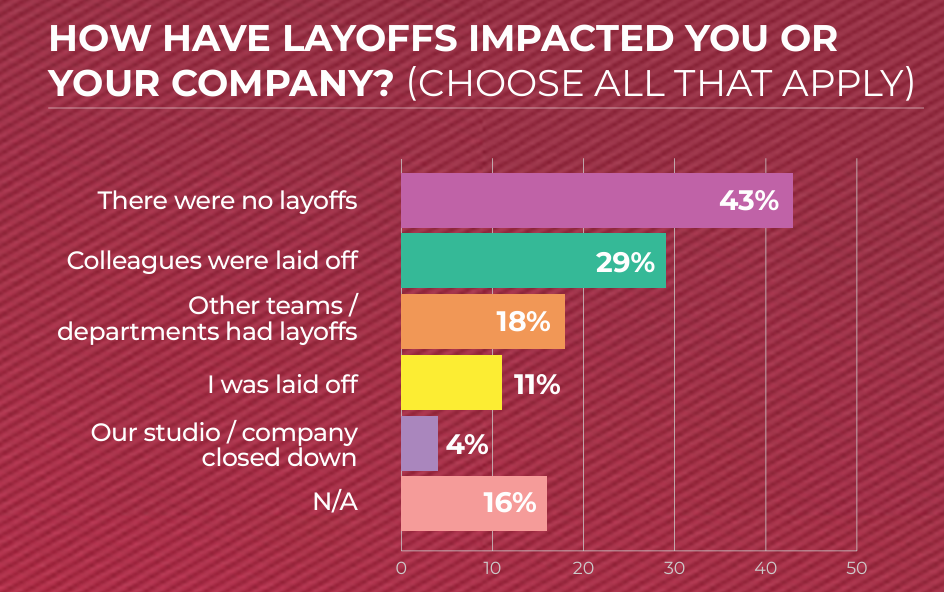

A pressing issue in the 2025 report is the persistent layoffs affecting game developers. Over one in ten developers (11%) reported being laid off in the past year, and 41% of developers have been impacted in some way, marking a notable increase from the previous year.

The causes of these layoffs vary. Company restructuring (22%), declining revenue (18%), and market shifts (15%) are among the top reasons cited.

However, many developers also attribute layoffs to poor leadership, unrealistic business expectations, and post-pandemic overexpansion.

Notably, 19% of developers reported receiving no explanation for the layoffs at their companies.

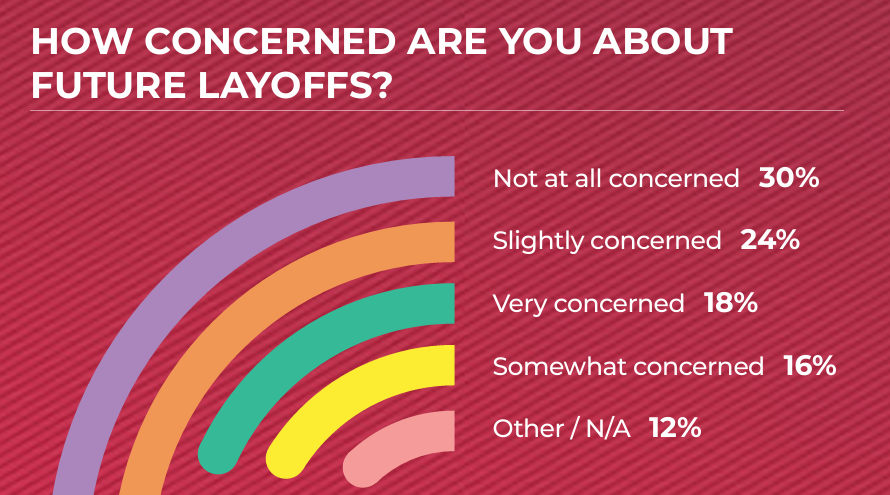

The concern for future layoffs remains high, with 58% of developers expressing some level of worry. Those impacted by job losses reported prolonged unemployment periods and difficulty re-entering the industry, highlighting the precarious nature of game development careers.

The Rise and Backlash Against Generative AI in Game Development

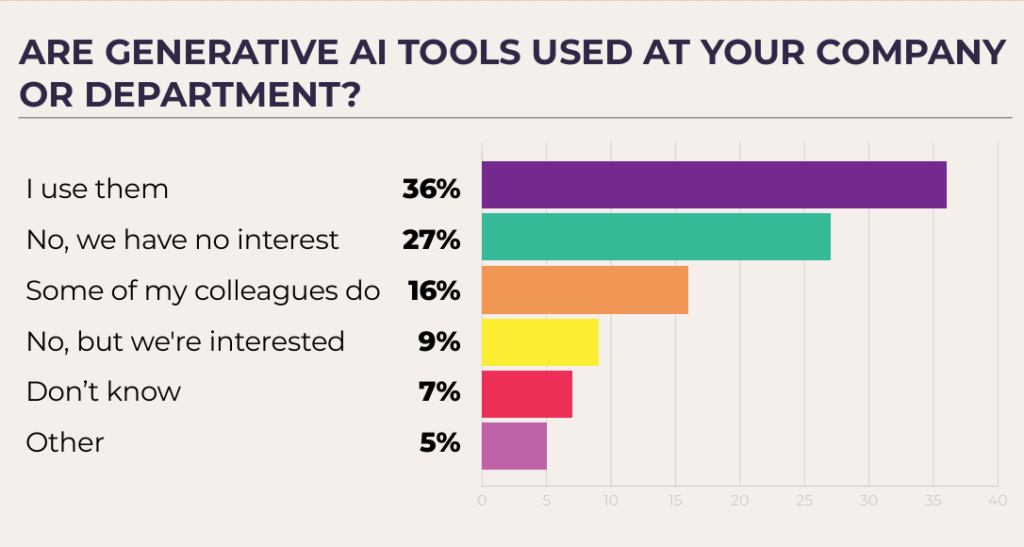

Generative AI is one of the most contentious topics in the gaming industry. While 52% of developers work at companies using AI tools, enthusiasm for AI appears to be waning. Only 9% of developers report their companies being interested in AI tools, down from 15% last year.

The survey reveals a stark divide: while AI-assisted tasks like coding assistance, 3D modeling, and automating repetitive tasks are recognized for their potential, the most common response from developers regarding AI usage was simply “none.”

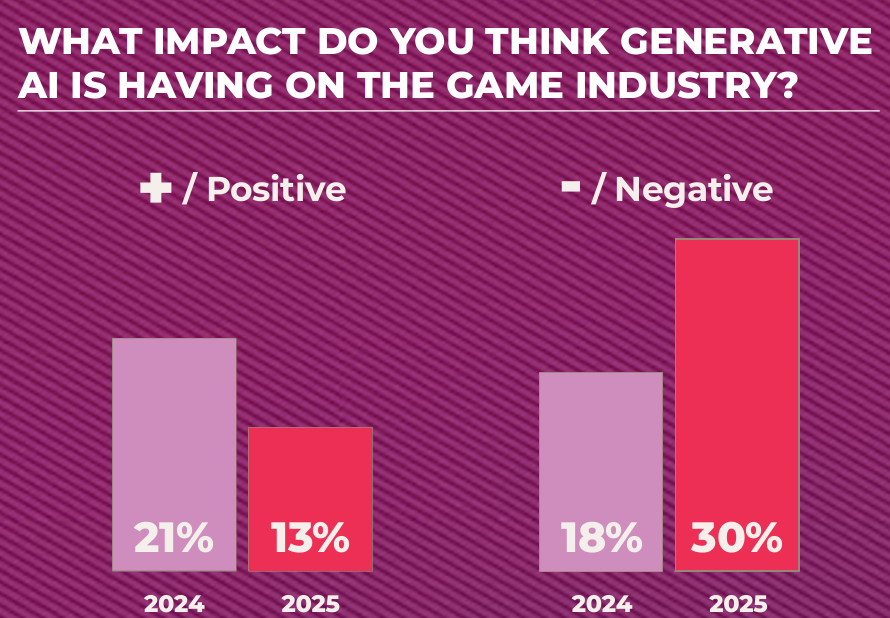

Developers have growing concerns about AI, with 30% believing it has a negative impact on the industry—a 12-point increase from 2024. Ethical concerns, intellectual property theft, and job displacement were frequently cited, reinforcing the skepticism surrounding AI in game development.

Interestingly, while AI is often linked to layoffs, developers who had been laid off were no more likely to oppose AI than those who had not.

Game Platform and Engine Preferences: A Shift Toward PC and VR

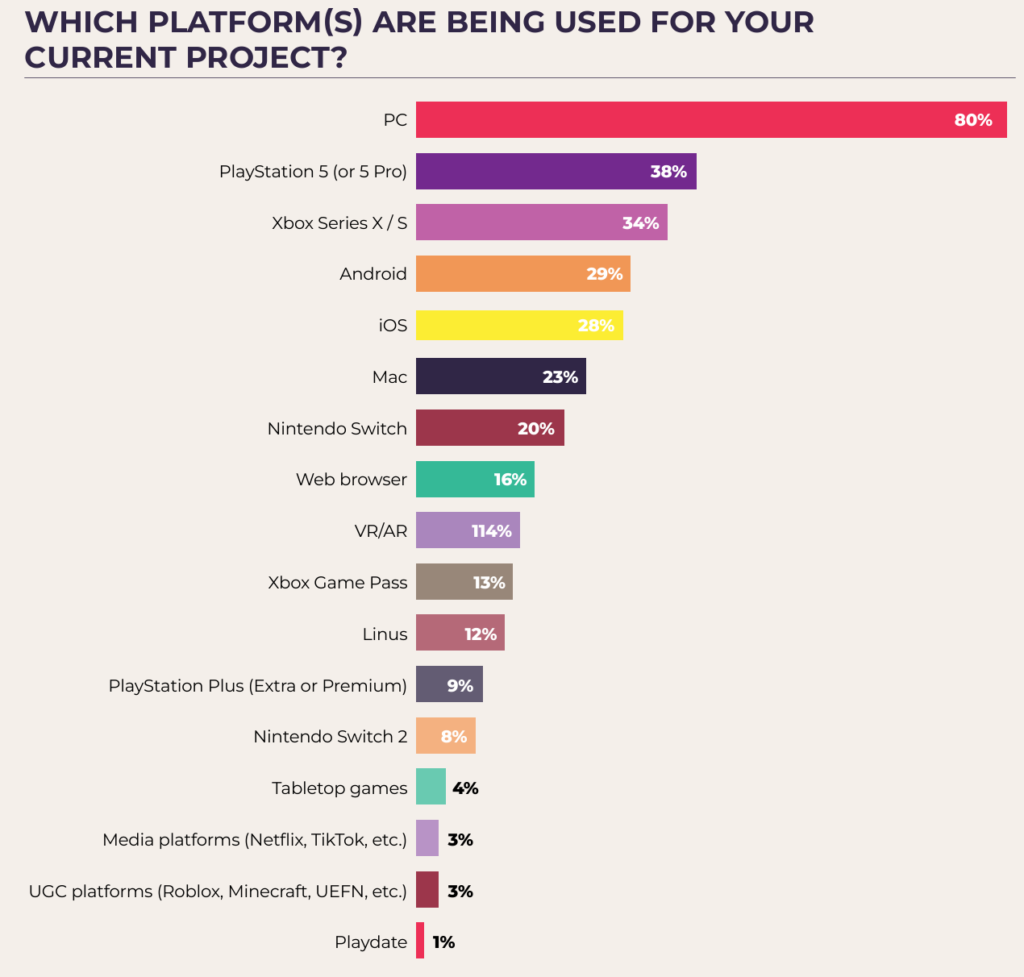

The 2025 report highlights a significant increase in PC game development.

Currently, 80% of developers are making games for PC, up from 66% last year. The rise in the Steam Deck’s popularity may be a contributing factor, as nearly 44% of respondents expressed interest in developing for the platform.

Console development remains steady, with 38% working on PlayStation 5 games and 34% on Xbox Series X/S.

However, mobile game development has seen a resurgence, particularly in regions like Brazil and Asia, where over 50% of developers work on mobile titles.

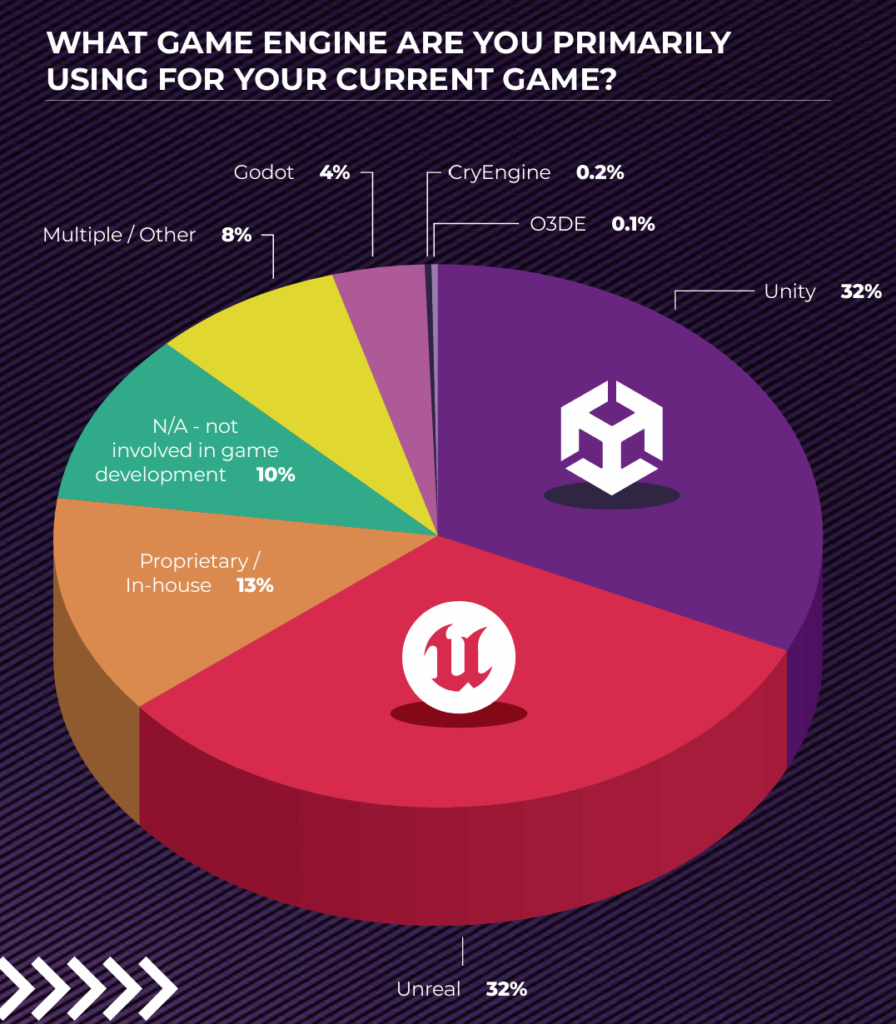

In terms of game engines, Unity and Unreal Engine continue to dominate, each being used by 32% of developers. Despite Unity’s controversial Runtime Fee policy announcement in 2024, its adoption remains steady, suggesting that most developers have not shifted away despite initial backlash.

Business Models and Industry Financing Challenges

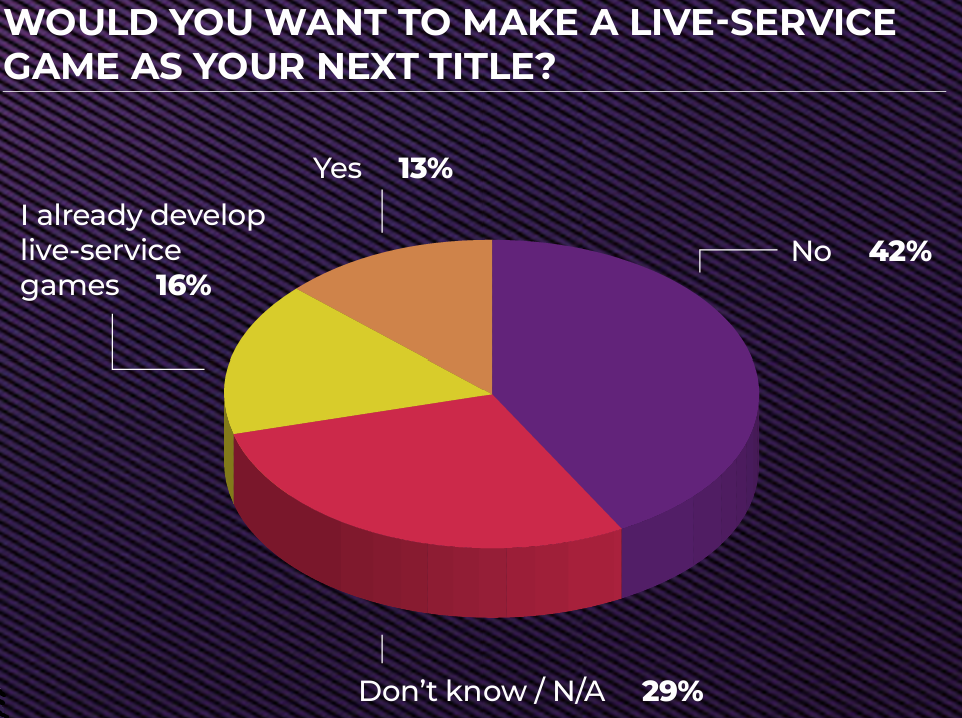

The business of games is evolving, with developers divided on live-service games. While 16% already develop live-service games, 42% of developers are not interested in pursuing this model. Market oversaturation, declining player interest, and monetization concerns are frequently cited as deterrents.

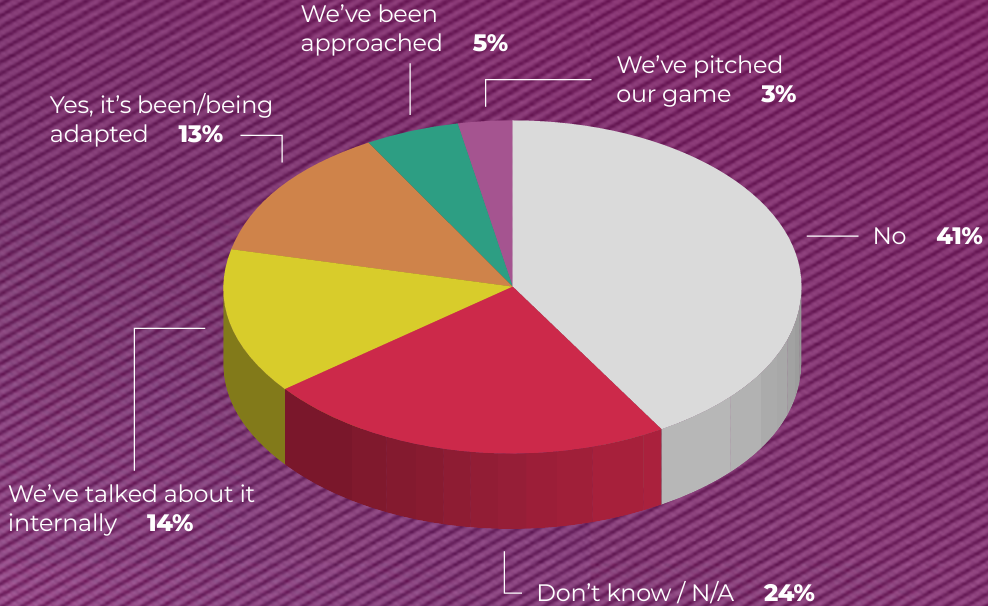

The Hollywood crossover trend remains strong, with 13% of developers involved in game-to-movie or TV adaptations, up from 10% in 2024. However, fewer developers are actively pursuing adaptations, suggesting a shift in interest.

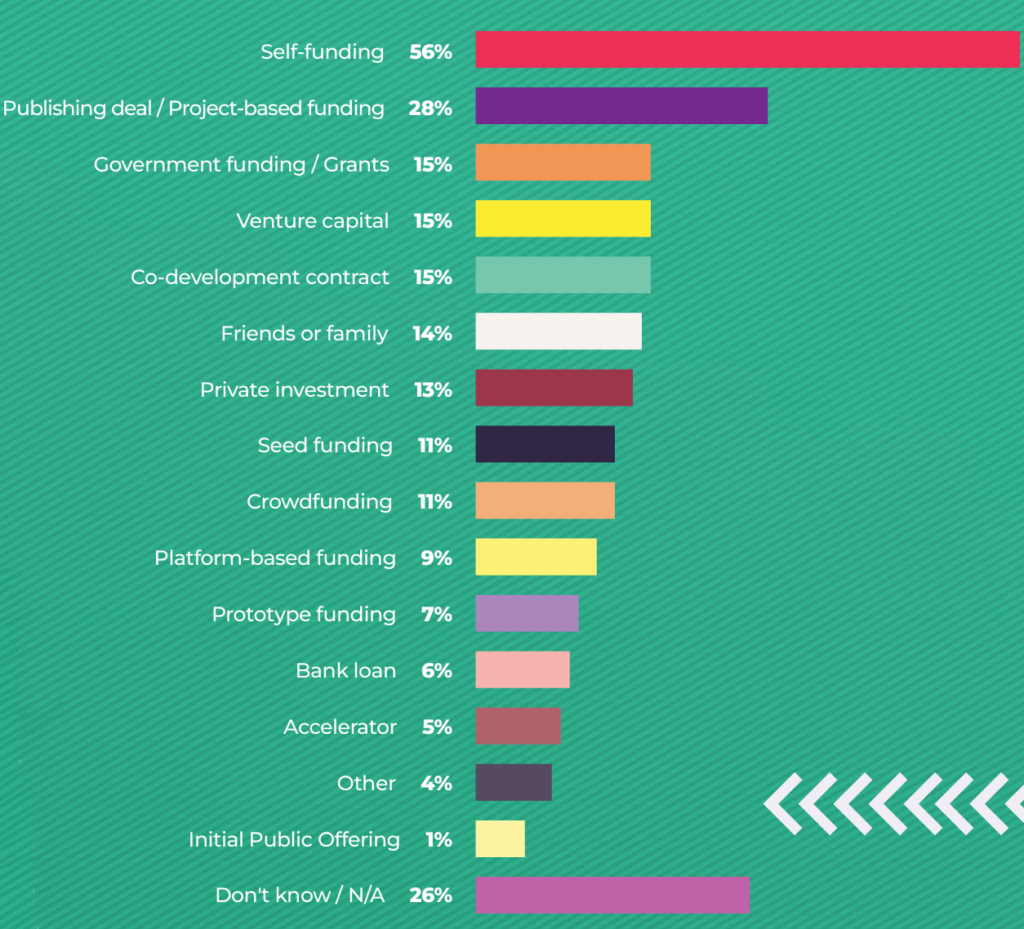

Regarding funding, self-funding remains the dominant method for game development, with 56% of developers investing their own money. Other financing options, such as publishing deals (28%), venture capital (15%), and government grants (15%), are less common and often difficult to secure. Developers cite market instability, competition, and lack of connections as major funding obstacles.

Industry Challenges: Work Conditions, Unionization, and Sustainability

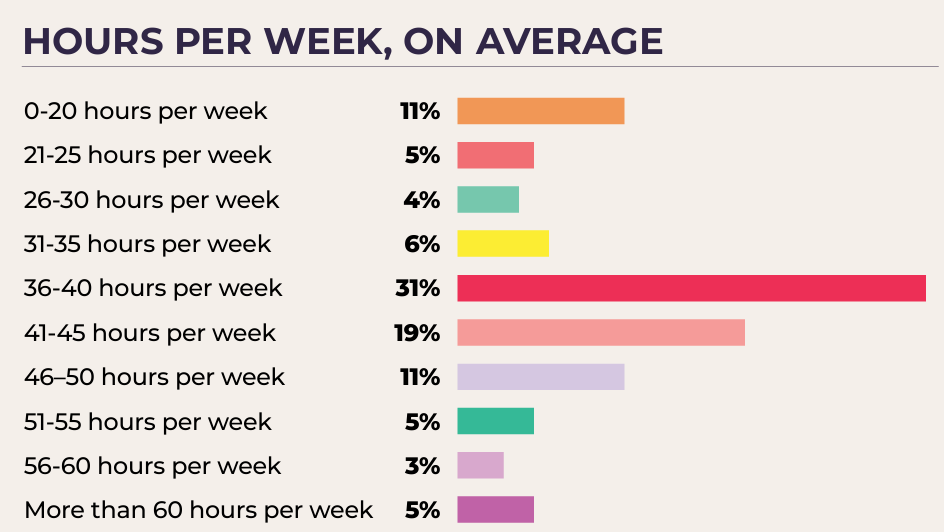

Work conditions in game development remain a point of concern. The number of developers working more than 40 hours per week has risen, with 13% working 51+ hours, up from 8% last year. Self-pressure remains the primary reason for overwork, but fear of repercussions and management pressure also contribute to excessive hours.

Unionization efforts have remained stable, with 58% of developers supporting unionization, particularly among narrative designers (89%) and QA testers (77%). However, some respondents worry that unions could negatively impact indie studios and creative freedom.

Sustainability and advocacy efforts show mixed progress. 71% of developers believe their company has been successful in diversity and accessibility efforts, but only 51% feel the same about sustainability. Additionally, 16% of developers have been directly impacted by natural disasters, a number expected to grow due to climate change.

Conclusion

The 2025 State of the Game Industry report paints a picture of a dynamic yet challenging landscape. While the industry continues to expand and diversify, it also faces major hurdles, including layoffs, AI controversies, funding difficulties, and workplace issues.

Despite these challenges, game developers remain resilient and adaptable, leveraging new opportunities in PC and VR development, diversified revenue models, and industry-wide advocacy efforts. As the gaming landscape continues to shift, staying ahead of technological advancements, labor rights movements, and sustainability initiatives will be crucial for shaping a stronger and more sustainable game industry in the years to come.

About us

Established in 2000 in Yokohama, Japan, GIANTY has evolved into a leading game and software development outsourcing studio.

We specialize in delivering innovative solutions across game development, art production, software development, and AI integration.

Our comprehensive services include 2D and 3D art design, mobile and PC game development, web and app development, and customized AI solutions.

With offices in Japan, Vietnam, and the United States, our global team ensures high-quality results, blending Japanese refinement with international expertise to exceed client expectations.