Every year, the organizers of the GDC (Game Developers Conference) release a report (snapshot) about the current state of the game industry. The GDC 2024 report was provided by the organizers last week.

This post will provide you with…

A structured view of the Game Industry status

Respondent demographics

1. This year’s GDC report was conducted with more than 3,000 game developers

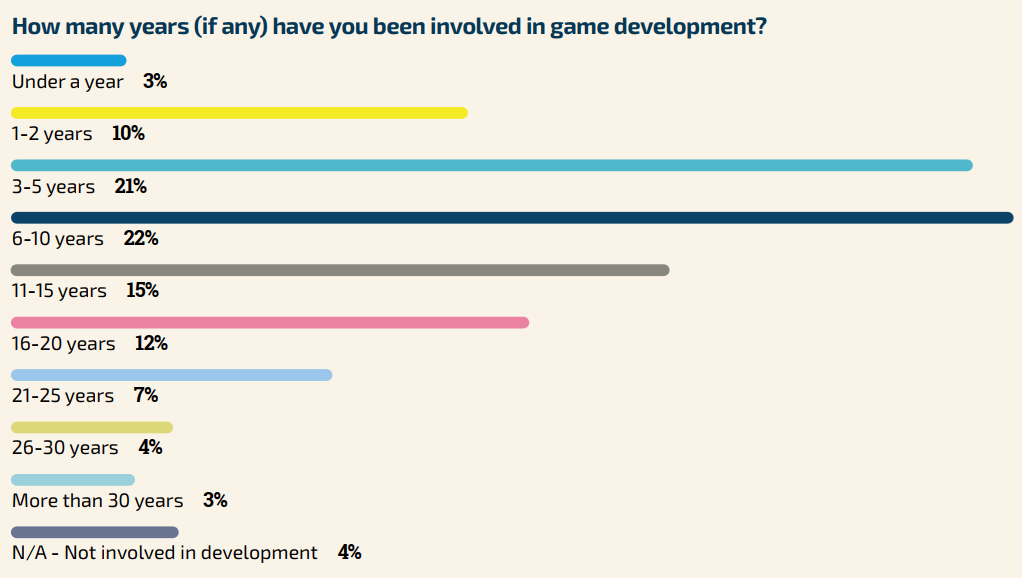

2. 56% of survey respondents have been in game development for 10 years or less

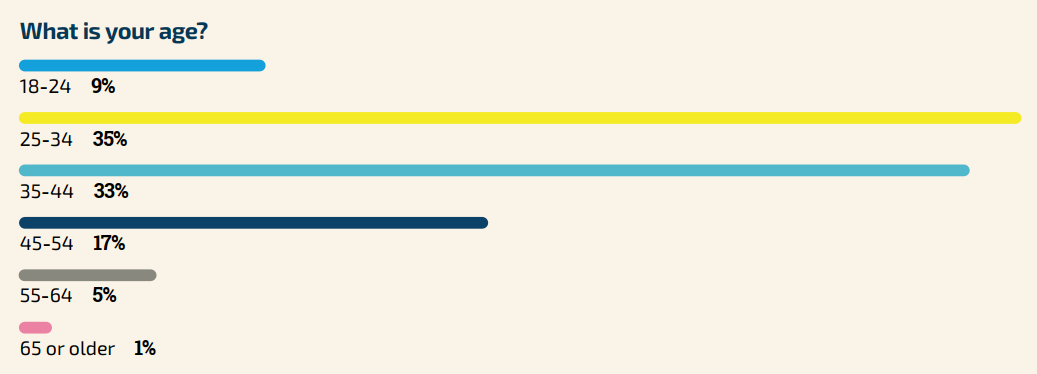

3. Millennials make up the majority of total respondents

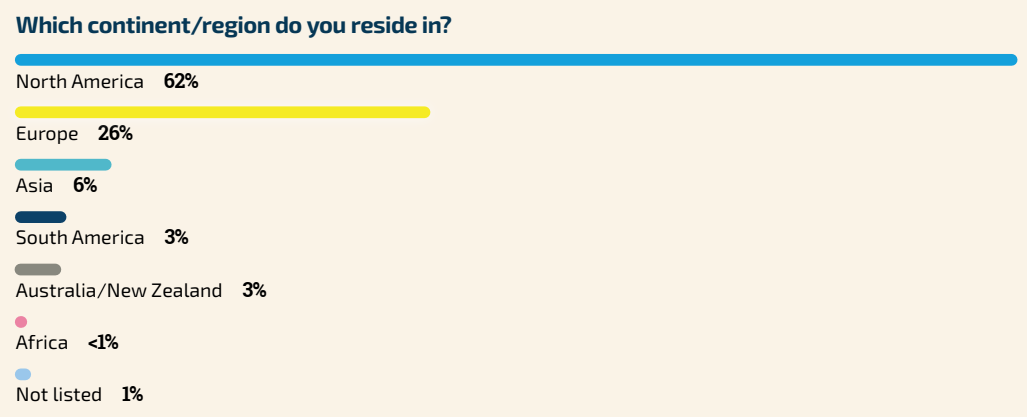

4. 88% of survey respondents are from Europe and America (of which 62% are from North America)

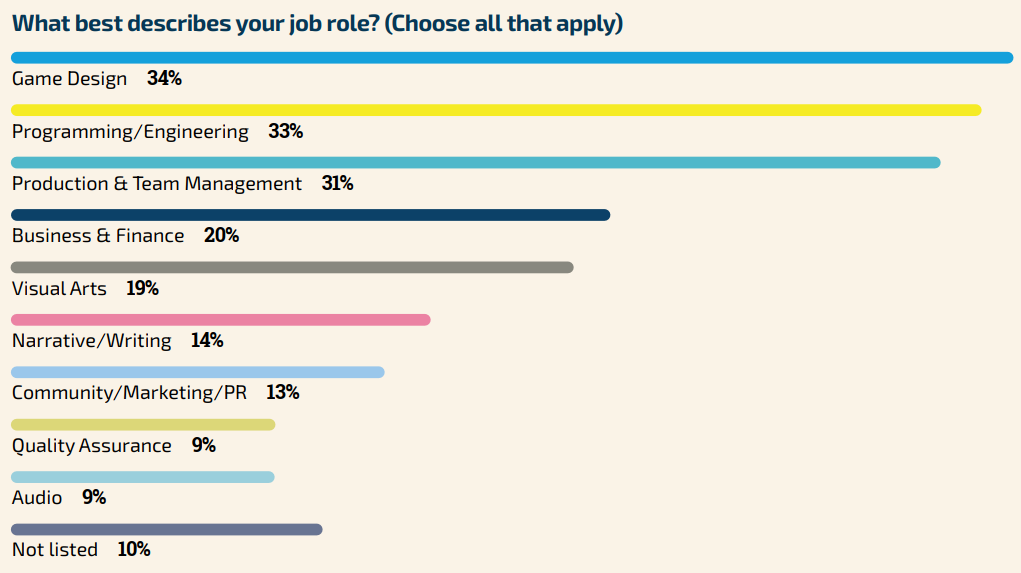

5. 67% are game design and programming/engineering. Almost half of 18–24-year-olds surveyed reported working in game design (45%) or programming (43%)

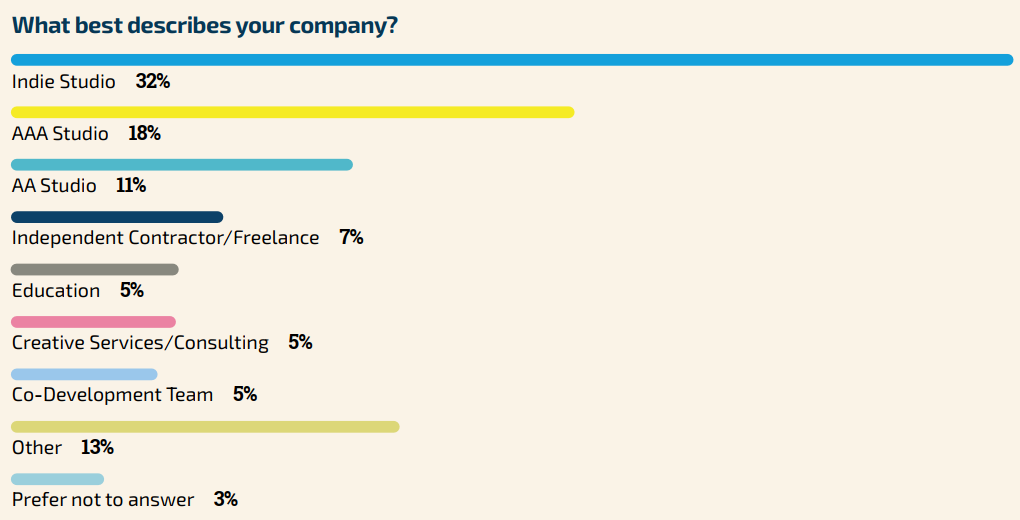

6. 32% work for indies studios, followed by AAA (18%) and AA (11%)

The Game Industry’s Regular concerns

Game development platform

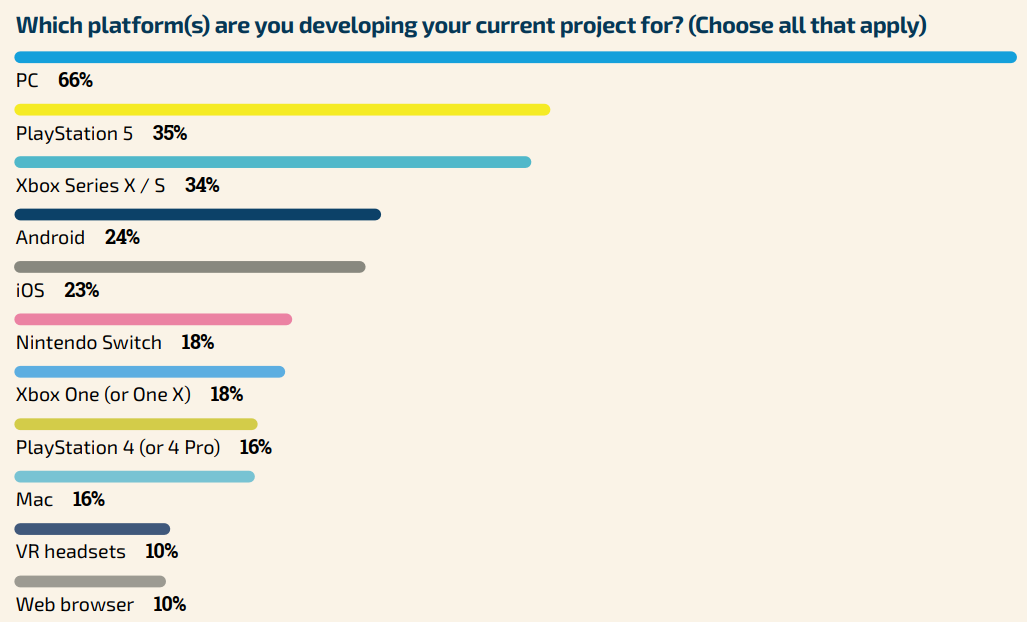

7. Current dominant platforms: the top is PC (66%), followed by Play Station 5 (35%) and Xbox Series X/S (34%)

8. Platforms for next projects: the top is still PC (57%), followed by Play Station 5 (33%) and Xbox Series X/S (30%)

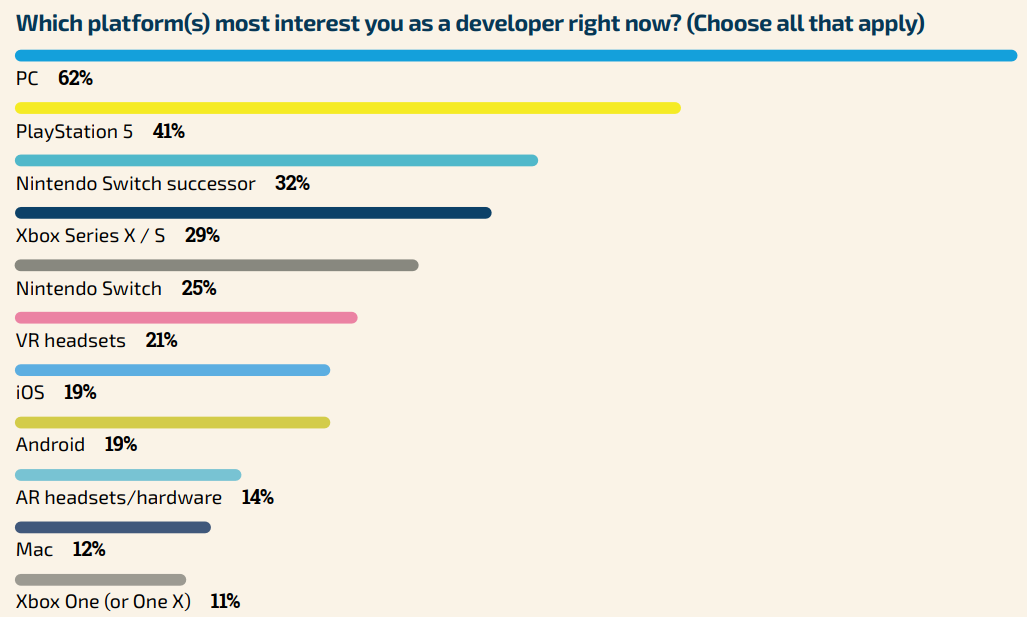

9. Platforms of interest: PC with 62%, followed by Play Station 5 (41%) and Nintendo Switch successor (32%)

10. Mobile platforms (Android, iOS) keep declining in popularity. 19% of respondents are interested in mobile platforms (less than 16% in 2023)

The development of AR/VR in Game Industry

11. 36% of respondents are involved in AR/VR game development, down from 38% in 2023

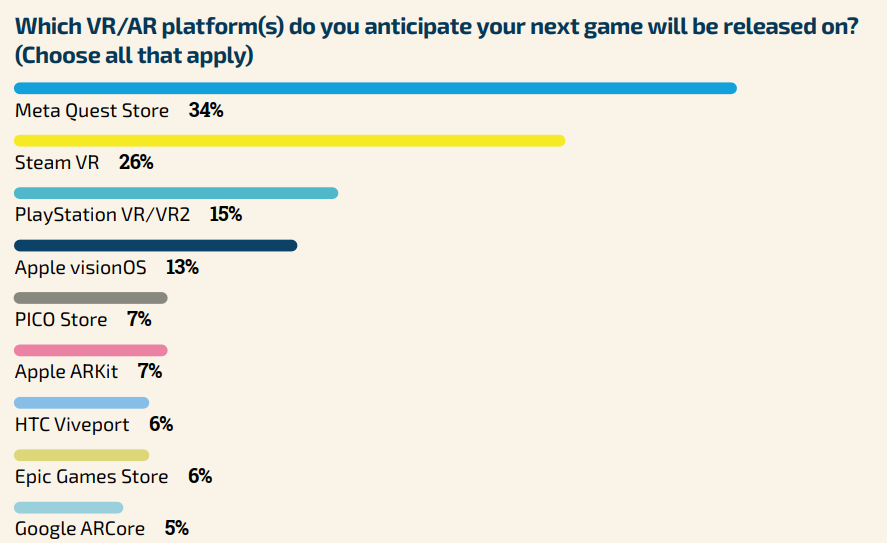

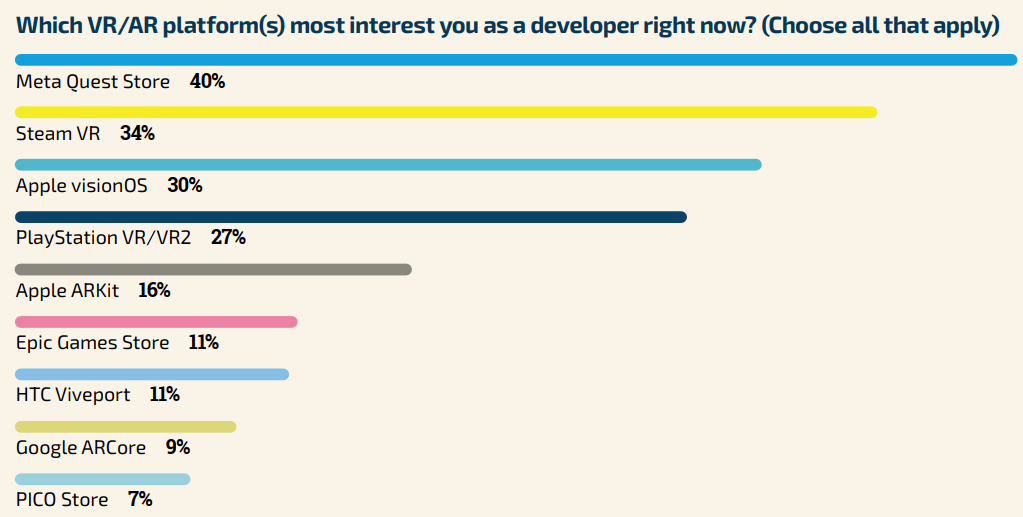

12. VR/AR projects favor Meta Quest for current (33%) and future (34%) games and also lead in developer interest

Blockchain application in the game industry

13. Interest in blockchain continues to decline. About 17% said their companies were somewhat or very interested in blockchain (down from 27% in 2023)

Business models

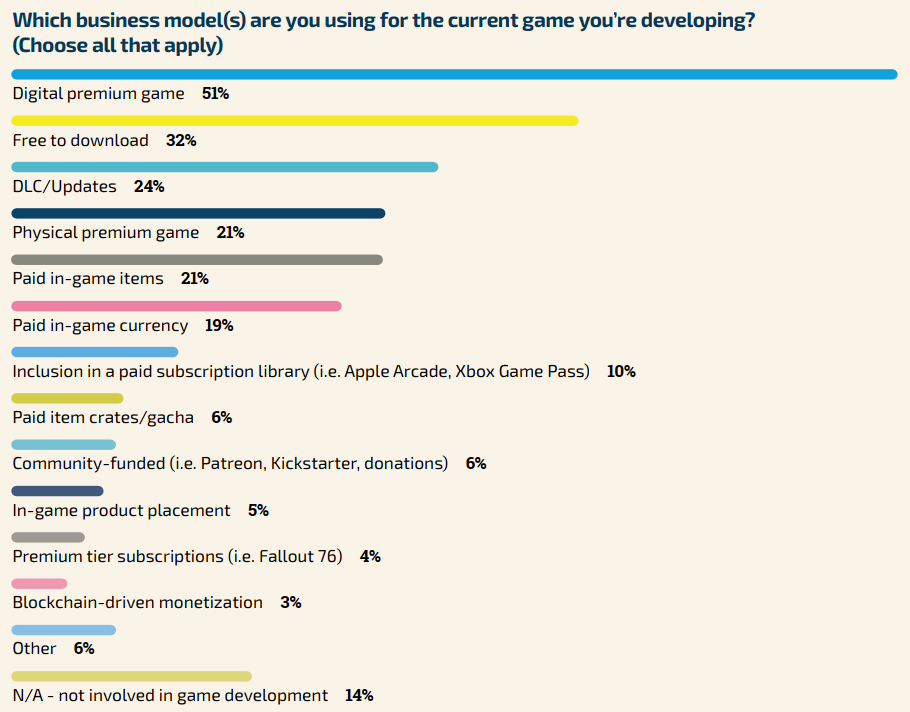

14. 51% of respondents said their current projects are Digital premium games, followed by Free to download, DLC content.

15. Premium tier subscription (4%), and Blockchain driver monetization (3%) are the least used

Marketing tools/channels for game promotion

16. Word of mouth (86%) and Social media (86%) were the most used tools, followed by Real-time communication (Discord, Slack 74%), Twitch or YouTube streamers (71%), and Live events (71%)

17. In-game crossovers and promotions (29%) were the least popular tools, followed by influencers (57%) and paid advertising (58%)

18. In social media, X (76%) was the most used platform for game promotion, followed by YouTube/Short (64%), Facebook (63%) and Linkedin (61%). About 20% are trying Threads, BlueSky, Mastodon and Cohost

19. Communication, Marketing, and PR use TikTok (57% more than all job roles) and Instagram (39% more)

20. Respondents from African countries highly use WhatsApp (54%). Respondents from Asian countries highly use regional-specific services (WeChat/Line, Sina Weibo, Tencent QQ)

21. X remains the dominant social media platform, but 97% expressed negative views about it, including frustration about X and its owner

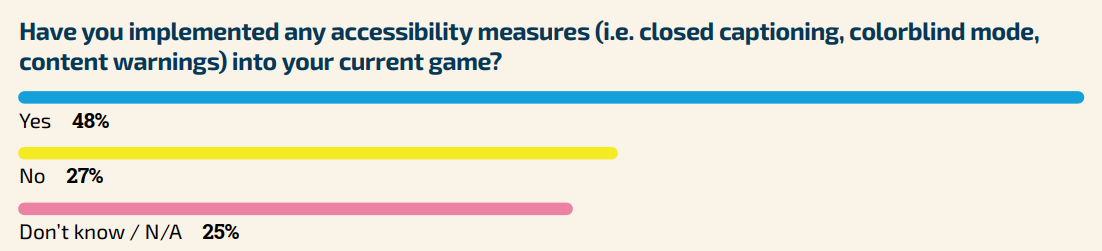

Accessibility measures in the game

22. 48% said their companies implemented Accessibility measures into current projects (up from 38% in 2023)

23. Types of Accessibility Measures include: Closed captioning, Colorblind mode, Control mapping, Content warning, Accessible hardware and controls, Phobia accommodation, Settings for motion sickness, Light sensitivity options, Vegan mode

Trending concerns

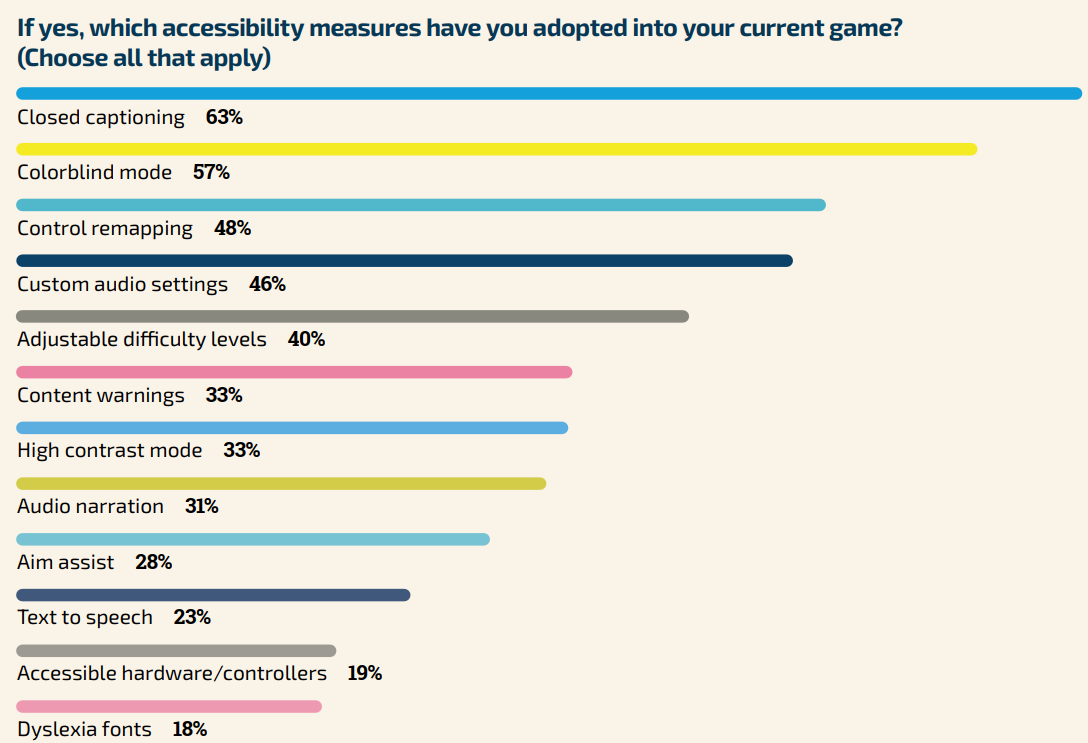

Switching Game Engines

The incident of Unity launching the Runtime fee policy in September 2023 caused a stir, and screams continuously rang out in the game-making community, especially indie game developers, making us feel like Sooner or later they will leave Unity to switch to other game engines. So, check what happened.

24. 33% of respondents listed Unity and Unreal Engine are the most used game engines

25. 35% of respondents considered switching game engines or already switched. Many cited Unity’s policies about “Runtime fee” as the main motivator

26. 51% of respondents were interested in switching to Godot

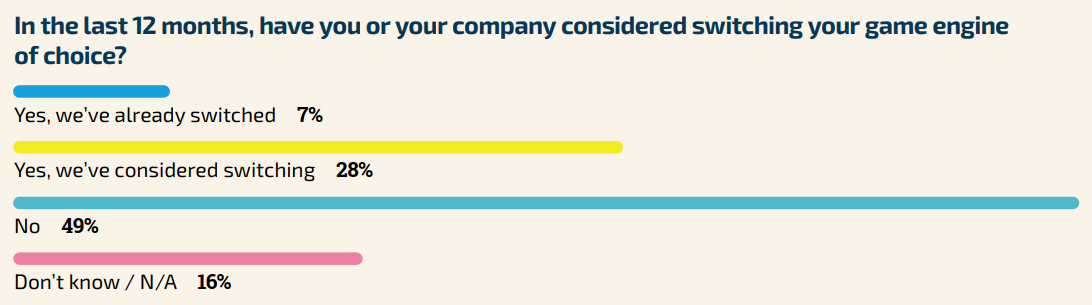

Impact of RTO (Return to Office) policy

Have you ever asked how people react to the Return to office policy? Let’s look at the numbers for the gaming industry alone.

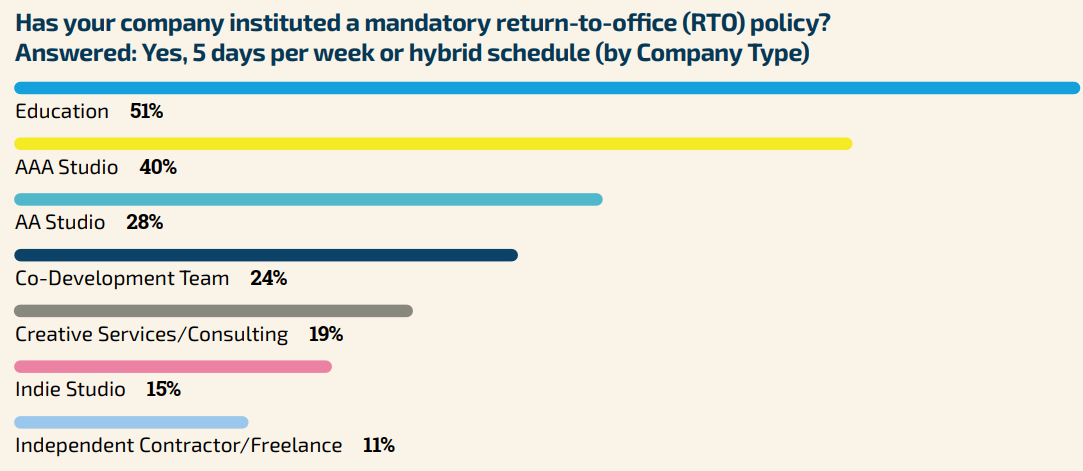

27. 26% said their companies have some form of RTO policy (full-time or hybrid)

28. AAA studios are far more impacted. 40% of them said they currently have RTO policies vs. 15% of indie developers and 28% of AA developers

29. Developers with the option to WFH have the most satisfaction, while those with mandatory RTO have the most dissatisfaction

Impact of the layoff wave

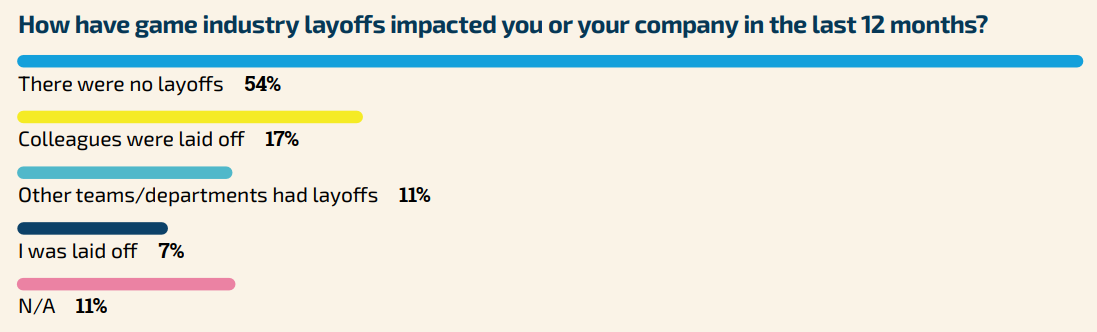

30. 35% said they’ve been impacted by layoffs

31. 22% of Quality Assurance developers said they were laid off last year. Business and Finance were least laid off (2%)

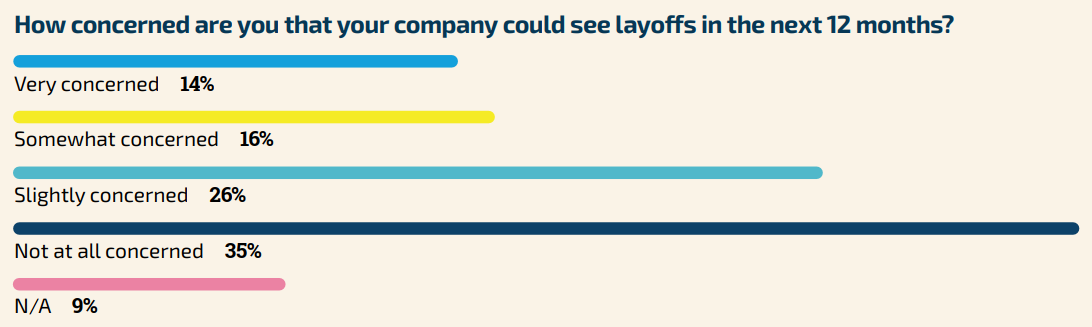

32. 56% show concern that companies could see layoffs in the next 12 months. They cited Post-pandemic correction, Studi conglomeration, and economic uncertain as possible explanations for the rise of layoffs

Impact of merger activities on the industry

33. 5% of respondents believe the wave of major acquisitions will be good for the industry, down from 17% in 2023. 43% believe it has a negative impact.

34. They expressed concerns about current and future acquisitions, including the risks of anticompetitive practices, increased risks of layoffs, and challenge of smaller companies

Impact of Generative AI

From the phenomenon of ChatGPT at the end of 2023, the trend of applying Generative AI to work is becoming increasingly popular, so in the Game industry, to what extent has this technology been applied?

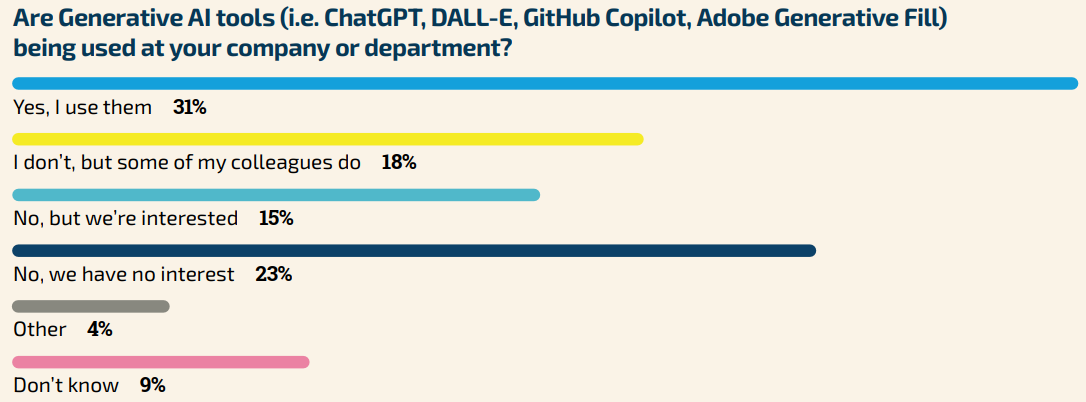

35. 49% of respondents said Generative AI tools are currently being used in the workplace. The areas that use Generative AI most are Coding assistance, Speeding up the content creation process, or Automating repetitive tasks.

36. Indie studio developers are most likely to use Generative AI tools (37%) vs. AAA and AA studios (21%)

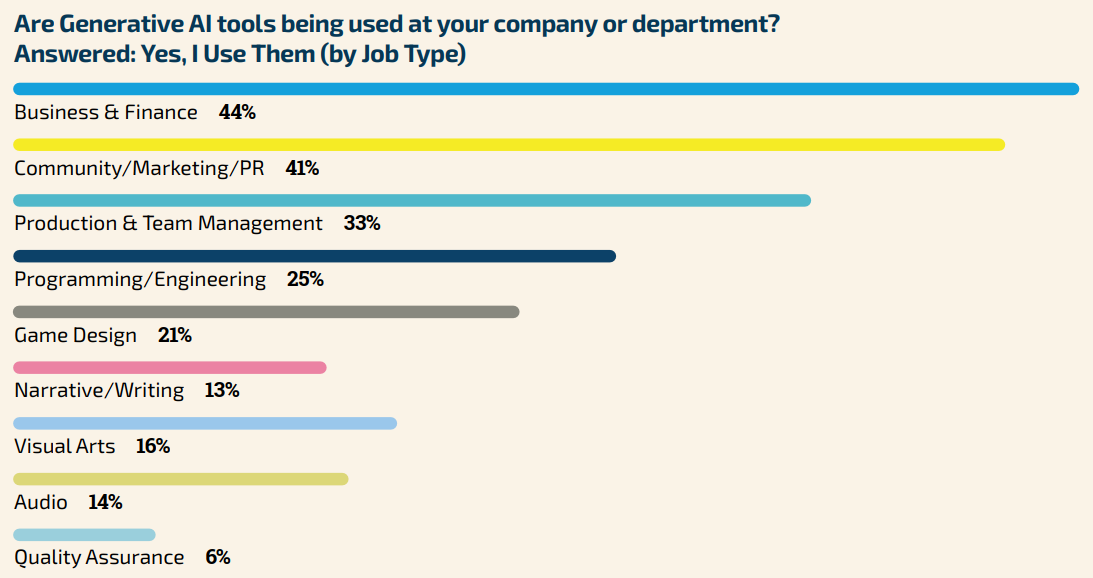

37. Bussiness and marketing are most likely to use Generative AI tools. QA & Narrative artists are in opposite.

38. 51% of respondents said their companies instituted the use of Generative AI policies. AAA studios likely to have company policies than indie studios.

39. 84% of respondents were somewhat or very concerned about the ethical impact.

Movies and TV Shows adaptation

This year, movies adapted from games such as Super Mario Bros., Five Nights at Freddy’s, and The Last of Us, Dungeons & Dragons have taken this activity to a new level. Many studios are eyeing dozens of games for future projects.

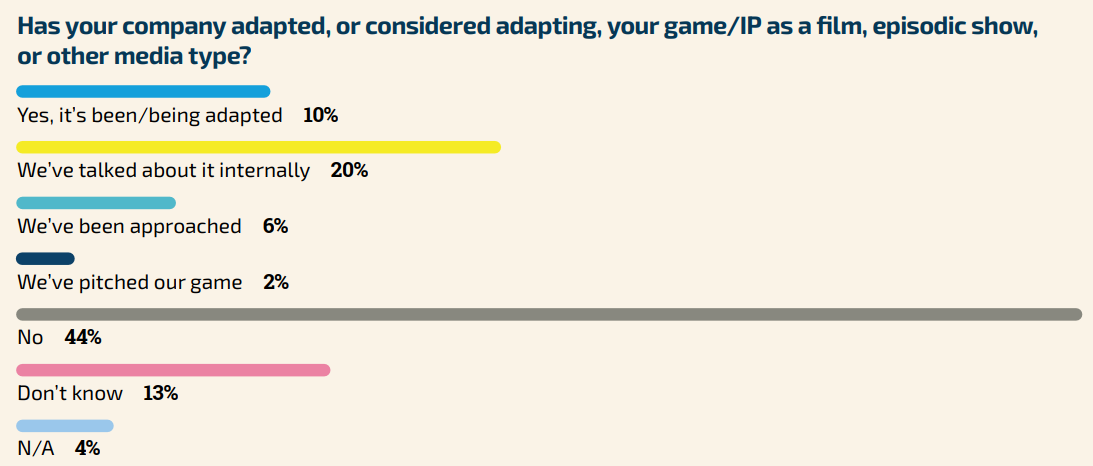

40. 10% of respondents said their game is being adapted into films, shows, and other media. It increases to 26% for AAA developers. Altogether, 38% of developers said film and TV adaptations of their game have been on table.

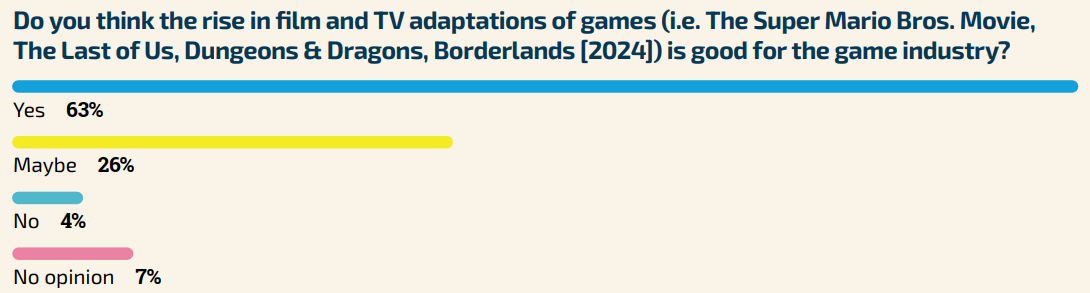

41. 63% of respondents said adaptation is a good thing. 4% said it is bad for the game industry. Many hope that adaptation could lead to more exposure to their games and they doubt most indie studios will benefit as much as larger studios.

GIANTY Team.